• An Autocall Barrier on each Observation Date that Early redeems the product returning the full initial investment.

• Conditional Coupons if the Underlying level is at or above the Coupon Barrier on the Observation Dates.

• A Protection Barrier at maturity.

Conditional coupons:

• On each Observation Date, if Underlying at or above the Coupon Barrier:

Autocall Event:

• On each Observation Date, if Underlying at or above the Autocall Barrier:

Redemption at maturity, in case of no Autocall:

• If Underlying at or above the Protection Barrier:

• Otherwise:

(Final / Initial level) x Initial Investment

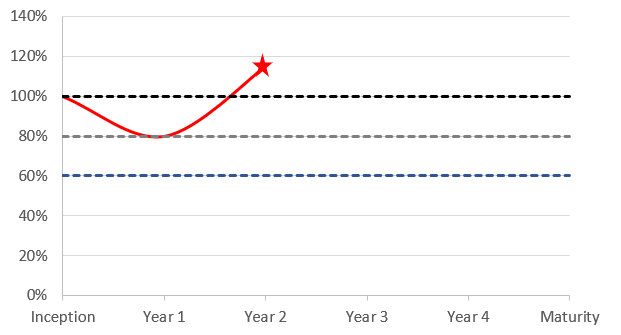

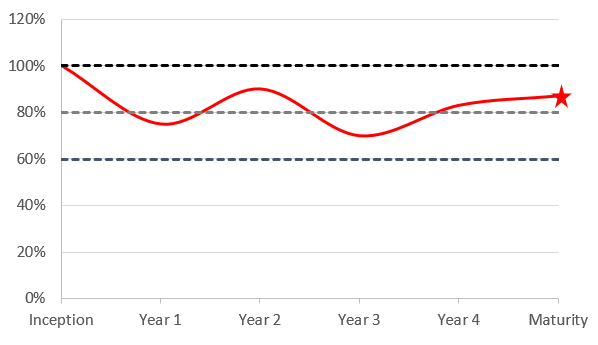

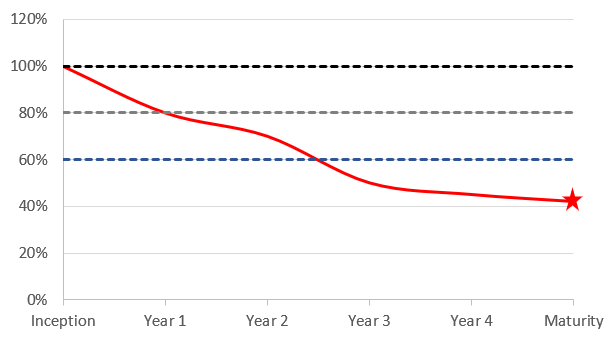

The illustration below have been made on a 5 year product with annual observations, assuming a 5% Coupon, an Autocall Barrier of 100%, a Protection Barrier of 60% and a Coupon Barrier of 80% over the initial level.

At year 1, the level of the underlying is below the Autocall Barrier and equal to the Coupon Barrier. The product continues and the investor receives the 5% coupon.

At year 2, the level of the underlying is above the Autocall Barrier. The product is early redeemed and the investor receives:

100% Initial Investment + Coupon of year 2 = 100% + 5%

On all the annual observations, the level of the underlying is below the Autocall Barrier. The product continues.

At year 2, year 4 and maturity, the level of the underlying is above the Coupon Barrier. The investor receives 3 x 5%.

At maturity, the level of the underlying is above the Protection Barrier. The investor receives:

100% Initial Investment

On all the annual observations, the level of the underlying is below the Autocall and Coupon Barriers. The product continues and no coupon is paid.

At maturity, the level of the underlying is below the Protection Barrier. The investor receives:

(Final/initial level) x Initial Investment

The objective of these illustrations is to present the product’s mechanism. Figures and prices in these examples have an indicative value, but can in no way be considered as a guarantee of future performance and do not constitute in any manner a firm price offer.